Company Profile

Weichai Juki Co., Ltd (hereinafter referred to as Weichai Heavy, SZ000880, former Mighty Corporation in 1998 and was listed at Shenzhen Stock Exchange due to fierce competition and poor management, after the year 2000, the performance of their companies have been on the decline, and in 2003 began the loss - making situation, faced with delisting risk due to fierce competition and poor management, after the year 2000, the performance of their companies have been on the decline, and in 2003 began the loss - making situation, faced with delisting risk .

of defending the interests of shareholders and the company's social image, in 2006, according to Shandong province automobile industry development planning and the restructuring and reforming SOEs, in a spirit of Weichai Heavy original assets, liabilities set out after,Weifang Diesel Engine Works and uses its medium - speed diesel engines and power - generation equipment including non - operational assets, Weichai Heavy, became the controlling shareholder of the Company's of defending the interests of shareholders and the company's social image, in 2006, according to Shandong province automobile industry development planning and the restructuring and reforming SOEs, in a spirit of Weichai Heavy original assets, liabilities set out after,Weifang Diesel Engine Works and uses its medium - speed diesel engines and power - generation equipment including non - operational assets, Weichai Heavy, became the controlling shareholder of the Company's . is sweet and succulent, rapidly reversed the loss - making enterprises of disunity, and realized the company business scope and strategic direction of a major shift, to ensure that the company get rid of the sustained, rapid and healthy development which lays the foundation for the is sweet and succulent, rapidly reversed the loss - making enterprises of disunity, and realized the company business scope and strategic direction of a major shift, to ensure that the company get rid of the sustained, rapid and healthy development which lays the foundation for the .

import company 5S management method, strengthen the lean production work, constantly improving on - site management, production organization and implement and control the whole import company 5S management method, strengthen the lean production work, constantly improving on - site management, production organization and implement and control the whole . 1996 achieved ISO9001 quality management system certificate,In 2004 the British Standards Institute BSI promulgated by ISO / TS16949: 2002 system certification, high - tech, high performance, high - quality service and best 1996 achieved ISO9001 quality management system certificate,In 2004 the British Standards Institute BSI promulgated by ISO / TS16949: 2002 system certification, high - tech, high performance, high - quality service and best .

enjoys great prestige both at home and abroad enjoys great prestige both at home and abroad.

Scope Of Business

production and sale of diesel, diesel genset and related products, parts and fittings;Engineering Manufacturing, Sales: Sales of machined, cast, raw, regulations governing the import and export business.diesel engine maintenance, waste handling

Company Products

Fruit after the implement of Weichai Heavy. It mainly produces series of 6160, 6170 series, 8170 series, CW200 series medium - speed diesel engines and diesel generating sets of 15KW to 1250KW currently, medium - speed diesel engines with a power overlay 164 - 1800 kW, wherein a Medium Speed Diesel Engine of Model 6160A National Quality Silver Award, the society has more than 10 million;CW200 engine company was established by the Chongqing branch of production, the introduction of M N A complete set of technical production and marketing of its advantages such as high reliability, economy, and the advantages of easy maintenance of the production company currently, medium - speed diesel engines with a power overlay 164 - 1800 kW, wherein a Medium Speed Diesel Engine of Model 6160A National Quality Silver Award, the society has more than 10 million;CW200 engine company was established by the Chongqing branch of production, the introduction of M N A complete set of technical production and marketing of its advantages such as high reliability, economy, and the advantages of easy maintenance of the production company .

Diesel Generating Set in 2004 through the adoption of a national communication specific certification, in 2005 and the adoption of the national internal combustion set quality supervision and inspection center of the plateau of the Rhine and the German certification center CE certification, and mainly includes a generating set for land use and marine generator sets, and can be widely applied to communication, railway, highway, broadcasting and television systems, airport ground power supply, air defense facilities,banks and high - rise buildings, hotels, hospitals, fire departments and other important types of ships as an uninterruptible power supply and standby emergency power supply common and Diesel Generating Set in 2004 through the adoption of a national communication specific certification, in 2005 and the adoption of the national internal combustion set quality supervision and inspection center of the plateau of the Rhine and the German certification center CE certification, and mainly includes a generating set for land use and marine generator sets, and can be widely applied to communication, railway, highway, broadcasting and television systems, airport ground power supply, air defense facilities,banks and high - rise buildings, hotels, hospitals, fire departments and other important types of ships as an uninterruptible power supply and standby emergency power supply common and .

Sales Management

The company built a national marketing network and maintenance services, spare parts supply center, after years of unremitting efforts, has a strong brand reputation and customer loyalty The company built a national marketing network and maintenance services, spare parts supply center, after years of unremitting efforts, has a strong brand reputation and customer loyalty . medium - speed diesel engines of marine power to occupy the home market and 80 per cent of market share, is the most popular and mature, marine products, and exported in large quantities in Vietnam, Indonesia, the Philippines, in the local enjoyed a high reputation brand;diesel in the domestic market and is China's largest producer of medium - speed diesel engines of marine power to occupy the home market and 80 per cent of market share, is the most popular and mature, marine products, and exported in large quantities in Vietnam, Indonesia, the Philippines, in the local enjoyed a high reputation brand;diesel in the domestic market and is China's largest producer of .

diesel power equipment diesel power equipment.

Future Development

the company will be bigger and stronger national power, and accelerate the introduction of marine power plant and to adapt to the Chinese market of new products, and quicken the pace of technical innovation, improve the enterprise competitiveness, expand domestic and foreign markets and keeping a sustainable healthy development, remain the Chinese medium - speed diesel and leadership in the world with a mighty the company will be bigger and stronger national power, and accelerate the introduction of marine power plant and to adapt to the Chinese market of new products, and quicken the pace of technical innovation, improve the enterprise competitiveness, expand domestic and foreign markets and keeping a sustainable healthy development, remain the Chinese medium - speed diesel and leadership in the world with a mighty . Lin Lin.

Financial Situation

Income Trends

Weichai Heavy 2009 third quarter income 17. 12 billion yuan, a year - on - year increase of 12%

Profitability Trends

Weichai Heavy 2009 net profit to 1.13 billion yuan (basic earnings per share 0.2 yuan) 4,100, a year - on - year growth of 94. 97%

Financial Analysis

Shandong Juli scale growth index over the past three years average sales growth of 2337. 10%, of all the companies in the ranking (10 / 1710), in which the same buildings, agricultural machinery and heavy truck industries was the top - 40 / 1, the epitaxial growth preferably EPS growth of Shandong have unmatched, huge strength compared with the past EPS growth rate of 663. 24%, all listed companies in the ranking / 1710 (29), in which the same buildings, agricultural machinery and heavy truck industry ranking of 2 / 40, company growth potential profitability indicators Shandong strength compared with those of the past three years the average profitability rate 627. 25%,In all of the listed companies ranking (50 / 1710), in the same buildings, agricultural machinery and heavy truck industry rank as (2 / 40) bears a strong profitability and stability of EPS in Shandong have unmatched, huge strength compared with the past stability of EPS in all listed companies ranking (707 / 1710), in which the same buildings, agricultural machinery and heavy truck industries ranked as 17 / bears a strong profitability and stability of EPS in Shandong have unmatched, huge strength compared with the past stability of EPS in all listed companies ranking (707 / 1710), in which the same buildings, agricultural machinery and heavy truck industries ranked as 17 / .

40 companies operating at a reasonably stable 40 companies operating at a reasonably stable.

Securities Information

Shortened Form of Securities Weichai Heavy type A former Shandong Juli ST Juli * ST Juli S * ST Juli listing state already listed listed countries / regions on the Chinese mainland exchange where the Company is listed on the Shenzhen stock exchange date 1998 - 04 - 02 was sold at a price (RMB) 11. 87 first - day closing price (30 yuan). 16 debut price (154%) 0.09 - day turnover rate (67%). 26 main underwriters: Guosen Securities Limited, the Listing Sponsor: Guosen Securities Limited, Audit institutions:Shandong Zhengyuan Accounting Firms with Limited Liability and letter 2

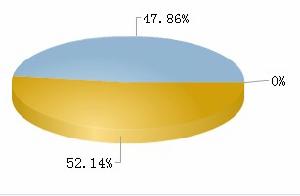

Equity Structure

Weichai Heavy shares for a total of 1.32 billion, total capital shares 47. 86%

The Prediction Mechanism

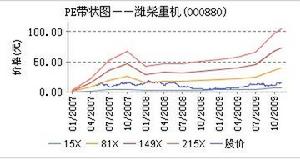

PE And

Shandong Juli history of earnings in the 15 - fold to 215 times expected earnings over the next 34, 2008 results underestimate the value of PE in a PE company listed companies all from the lower to the higher front 37. 8%, in a rational position so that the 2009 consensus expectations of PE in all listed companies forecast profit of PE from the lower to the higher front 44. 6%, in a rational position

Position Structures On U

Shandong strength compared with that in 2008, the shareholders tended to decrease as households, institutions reduced holdings in the latest quarter Shandong strength compared with that in 2008, the shareholders tended to decrease as households, institutions reduced holdings in the latest quarter . conditions last week suggested that an average increase in the latest conditions last week suggested that an average increase in the latest .

mechanism position is 1. 44%, part of the mechanism on the Unit's comments have been up - regulated, up - regulation of bin 3. 06%

Value Assessment

comprehensive investment advice: Shandong Juli (000880) comprehensive score is indicative of a preferred stock investment value, using a comprehensive valuation of the stock's valuation range in 21. 23 55 -. 70 yuan, the shares are currently undervalued in region, can safely hold 12 step assessment value investment advice: comprehensive of the 12 - step for the company's assessment, the preferred stock investment value, advice on the involvement of the attitude of the 12 step assessment value investment advice: comprehensive of the 12 - step for the company's assessment, the preferred stock investment value, advice on the involvement of the attitude of the .

rating industry investment advice: Shandong Juli (000880) falls into the category of machinery manufacturing industry, the industry investment value, the industry's overall ranking is 13th in quality rating rating industry investment advice: Shandong Juli (000880) falls into the category of machinery manufacturing industry, the industry investment value, the industry's overall ranking is 13th in quality rating . growth investment advice:Shandong Juli (000880) growth ability is good, and great potential for the next three years, which is ranked 153 total growth ability, growth ability of the industry in which the 4th - ranked name growth investment advice:Shandong Juli (000880) growth ability is good, and great potential for the next three years, which is ranked 153 total growth ability, growth ability of the industry in which the 4th - ranked name .

rating and profit forecast: Shandong Juli (000880) forecast 2009 earnings per share of $0. 57 yuan, 2010 earnings per share of $0.74 yuan, 2011 earnings per share of $0. 90 yuan, the current of the target on the stock from 21. 55 yuan, the investment rating is puissant buy