Introduction

Shanghai foreign trade import and export of Shanghai - based Shenda Co., Ltd. and Shanghai Bada Textile Clothing Co., Ltd., Shanghai Shenda Co., Ltd. two wholly - owned subsidiary, engaged in the import - export business for 20 - plus years of history, and its export scale and benefit for several years in the national textile system, China's Export of Textile (CCCT) Home Textiles Committee, and also the title of deputy chairman in according to Chinese textile exporters, will, and Garment Association, China General Chamber of Commerce and the compilation of the "2006 - 2007 China Garment Industry Development Report,I am in the 2006 National Study of ERP Practice in the top 100 enterprises in the ranking of people under the name according to Chinese textile exporters, will, and Garment Association, China General Chamber of Commerce and the compilation of the "2006 - 2007 China Garment Industry Development Report,I am in the 2006 National Study of ERP Practice in the top 100 enterprises in the ranking of people under the name .

9 over the years the company was awarded Shanghai Excellent Export Enterprise 9 over the years the company was awarded Shanghai Excellent Export Enterprise . 2004, companies which export a total of $470, export enterprises in Shanghai was awarded the Silver Award, Shanghai exports Enterprises in the top 100 ranked No. 34 and No. 53 - bit

2006 export total of US $468 million 2006 export total of US $468 million . Sundarban foreign trade vigorously perform our internal management, 2000 both by 94 version of ISO9002 quality authentication, the adoption in 2003 of 2000 Version ISO9001 quality certification,The recertification audit, 2006 through June 2007 through the adoption of the yearbook and Sundarban foreign trade vigorously perform our internal management, 2000 both by 94 version of ISO9002 quality authentication, the adoption in 2003 of 2000 Version ISO9001 quality certification,The recertification audit, 2006 through June 2007 through the adoption of the yearbook and .

review starting in 2004, to promote ERP business and financial information system, the company will be 18 influence the internal management system so as to increase to 26, which is a set of work efficiency, dared to dare to award a penalty, the survival of the fittest of the interior, from the company to make management more standard review starting in 2004, to promote ERP business and financial information system, the company will be 18 influence the internal management system so as to increase to 26, which is a set of work efficiency, dared to dare to award a penalty, the survival of the fittest of the interior, from the company to make management more standard .

On Business

Shanghai Foreign Trade export - high count yarn, fabric, fine extra - width fabric dyeing, spinning wool, various types of garments, geotextiles, and filter cloth, decorative cloth and various string bands and other products, advanced equipment, complete functions, a variety of novel features, the products sell well in all parts of the world, owns the "Sundarban" and "Ruijie" and a number of other brands, is welcome by customers, and won good reputation in the world market now Shanghai Foreign Trade export - high count yarn, fabric, fine extra - width fabric dyeing, spinning wool, various types of garments, geotextiles, and filter cloth, decorative cloth and various string bands and other products, advanced equipment, complete functions, a variety of novel features, the products sell well in all parts of the world, owns the "Sundarban" and "Ruijie" and a number of other brands, is welcome by customers, and won good reputation in the world market now . company with more than 120 countries and regions of more than 1000 Customers and established the firm business relationship company with more than 120 countries and regions of more than 1000 Customers and established the firm business relationship .

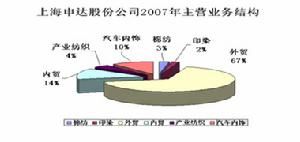

Sundarban foreign trade develop its own characteristics and advantages, and aiming at the international advanced level, try to grasp the opportunitiesstrengthen the foreign trade policy, through the acquisition of equity, expanding the investment proportion, investment founded new garment factory, owned by Tazreen Fashions was Wu Shenda, Shanghai Da Li Clothing Factory, Shanghai Xu Shen Fashion Co., Ltd (built in 2003), Kunshan Shende Garment Co Ltd (2004) and the like) represents a new level, new mechanisms for the transfer of settlers of the base, thereby improving the quality of its exports of services by business Sundarban shares seven bulk: foreign trade, the automobile interior, domestic trade, cotton yarn, industrial supplies, Sundarban shares seven bulk: foreign trade, the automobile interior, domestic trade, cotton yarn, industrial supplies,.

dyeing wherein the foreign trade sector is the largest contributor to the automobile sector as its performance was the best, fastest - growing sector supplies industry, asset - intensive industries, which have had the effect of dyeing wherein the foreign trade sector is the largest contributor to the automobile sector as its performance was the best, fastest - growing sector supplies industry, asset - intensive industries, which have had the effect of .

Company Structure

market listing on Shanghai's industry of textile, clothing, fur and the registered capital (Yuan) 47349. 521099999998 representative Xi when Xi Ping, chairman of Ping An is General Manager, Secretary of the Board of Directors Xiuqing Ma Tianyu securities representative Luo Qiong Lin registered address Pudong Road Hongshan 176 118 No. Postal Code 200042 office address Shanghai Wuning Road (No. 488, Wisdom Plaza, Certificate 18 200042)

The Operational Level

Wang Liping, director of resources for 2004 - 06 - 29 2008 - 02 - 14 transferred Wang Liping, director of resources for 2004 - 06 - 29 2008 - 02 - 14 transferred . Ann Xiuqing General Manager 2004 - 06 - 29 Liu Deputy General Manager Fu root 2004 - 06 - 29 Yao Ming Hua, vice - general manager of 2004 - 06 - 29 Ding Zhenhua Financial Controller from 2004 - 06 - 29 Ma Tianyu, deputy general manager of 2004 - 06 - 29 Hu Deputy General Manager Chun 2004 - 06 - 29 Wang Rong, vice - general manager of 2007 - 12 - 10 Ann Xiuqing General Manager 2004 - 06 - 29 Liu Deputy General Manager Fu root 2004 - 06 - 29 Yao Ming Hua, vice - general manager of 2004 - 06 - 29 Ding Zhenhua Financial Controller from 2004 - 06 - 29 Ma Tianyu, deputy general manager of 2004 - 06 - 29 Hu Deputy General Manager Chun 2004 - 06 - 29 Wang Rong, vice - general manager of 2007 - 12 - 10.

Ten Shareholders

No names of shareholders and the quantities of the shareholding proportion of the equity nature of the State - Owned Assets Supervision and Administration Commission of Shanghai Municipality on 1 14712. 83 million 31. 070% A - 2 of the Agricultural Bank of China - - the agency that the core growth Stock Securities Investment Fund 1079. 96 million 2. 280% 3 A - shares in Shanghai International Trust Co., Ltd., a 487 1.87 1 0.030% A - omino - 4 Industrial and Commercial Bank of China stock investment funds to 452 million 0. 950% 5 A - shares in Shanghai Bailian Group Co., Ltd.; 320. 37 million 0. 680% of the shares for CMB - SSE Dividend exchange - traded securities investment fund 262. 200,000 0. 550% shares for 7 223 at Shenyin Wanguo Securities Co., Ltd. is expected to reach 120,000 0. 470 8 per cent of the shares for Wu Lieguang 188. 320,000 0. 9% 400 shares for Shanghai Jinqiao (Group) Co., Ltd.) and 620 0. 340% Stock 10 Yan Quanliang 158 million as the 0. 330% circulation share

Equity Structure

The equity structure information: Shenda Co shares for a total of 4. 73 billion, total capital shares 100. 00% dividend and raising contrast: Sundarban shares since the A - share offering to shareholders with dividend 13 times for a total of 5 billion yuan;raised a total of 3 times 1. 05 billion

Position Structures On U

Shenda Co in 2008, the shareholders tended to decrease as households, the proportions of open interests mechanism increases Shenda Co in 2008, the shareholders tended to decrease as households, the proportions of open interests mechanism increases . latest quarters last week suggested that an average increase of 33 positions latest quarters last week suggested that an average increase of 33 positions .

latest mechanism. 87%, a portion of the mechanism on the Unit's comments have been up - regulated, up - regulated positions 58. 24%

Business Content

Financial Analysis

scale growth indicators in the Sundarban shares over the past three years the average sales growth rate of - 0. 83%, of all the companies in the ranking (1448 / 1710), and it's a dealer no. 11 / 20, the epitaxial - growth reasonably EPS growth Sundarban stake past EPS growth rate of 18. 83%, of all the companies in the ranking (693 / 1710), which are the of the Distributor's industry ranking is 7 / 20, take the rational measure of profitability, Sundarban shares over the past three years the average profitability growth is 18. 89%, of all the companies in the ranking (891 / 1710),In industries where the dealer is ranked (10 / 20) profitability with reasonable stability over the past EPS EPS Sundarban shares in listed companies rank stability all (499 / 1710), which are the of the Distributor's industry ranking is 9 / 20 profitability with reasonable stability over the past EPS EPS Sundarban shares in listed companies rank stability all (499 / 1710), which are the of the Distributor's industry ranking is 9 / 20 .

stabilizing the management the reasonable stabilizing the management the reasonable.

Value Assessment

A Comprehensive Appraisal of comprehensive investment advice: Shenda Co (600626) composite score indicates that the shares in investment value (★★) A Comprehensive Appraisal of comprehensive investment advice: Shenda Co (600626) composite score indicates that the shares in investment value (★★) . 12 step assessment value investment advice: comprehensive of the 12 - step for the company's assessment, the stocks investment value (★ ★★), it is recommended you for the company taking a 'wait and see attitude, waiting for better investment opportunities 12 step assessment value investment advice: comprehensive of the 12 - step for the company's assessment, the stocks investment value (★ ★★), it is recommended you for the company taking a 'wait and see attitude, waiting for better investment opportunities .

rating industry investment advice: Shenda Co (600626) belonging to the trade in manufactured goods and sales of the industry, the industry investment value (Confidential), the industry's total ranked as the No. 51 as the rating quality growth investment advice:Shenda Co (600626) growth is weak (*), the Unit's ability to grow the total ranked 1059 name, industry growth ability ranked 9th in the name of the rating quality growth investment advice:Shenda Co (600626) growth is weak (*), the Unit's ability to grow the total ranked 1059 name, industry growth ability ranked 9th in the name of the .

rating industry industry market relative strength ★★ ★ industry growing ★★★★ ★★ mechanism recommended industry concentration degree ★★★★ industry comprehensive star ★★ ★ risk assessment value at risk VAR 13. 1% month on month change of 0. 3% of the variance of the 3. 6% of the maximum profit (RMB). The largest losses (95 yuan) 0. 95

Financial Data

the income trend: Shenda Co 2009 second quarter revenues 23. 47 billion yuan, representing a decline of 3. 08% profitability trends: Shenda Co in the first half of 2009 net profit of 37 million yuan (basic earnings per share from 0. 0835) yuan, a year - on - year drop of 45. 37%

Investment Direction

1. The company business includes textiles based foreign trade business, automobile textiles business, and other industrial textile businesses, conventional textile business,real estate purchase and sales business, etc. The company in 2009 for the first three - quarters of major financial indexes: income per share of 0.15 yuan (1232), net assets per share 3. 6240 (yuan), ROE 3. 3987%, operating income 3735727084. 7900 (yuan), compared with a year - on - year increase and decrease of 10 -. 8518%; net profit for shareholders of the listed company of 58320800. 89 (yuan), compared with a year - on - year increase and a decrease in the 29 - 0.4237% 3. Company's 2008 annual profit distribution scheme is that for every 10 shares at 1 yuan (including tax) to shareholders of record on

: on June 11, 2009; ex: June 12, 2009; cash dividend distribution date: June 19, 2009 : on June 11, 2009; ex: June 12, 2009; cash dividend distribution date: June 19, 2009 .